high low method machine hours

The high-low method comprises the highest and the lowest level of activity and comparison of the. In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data.

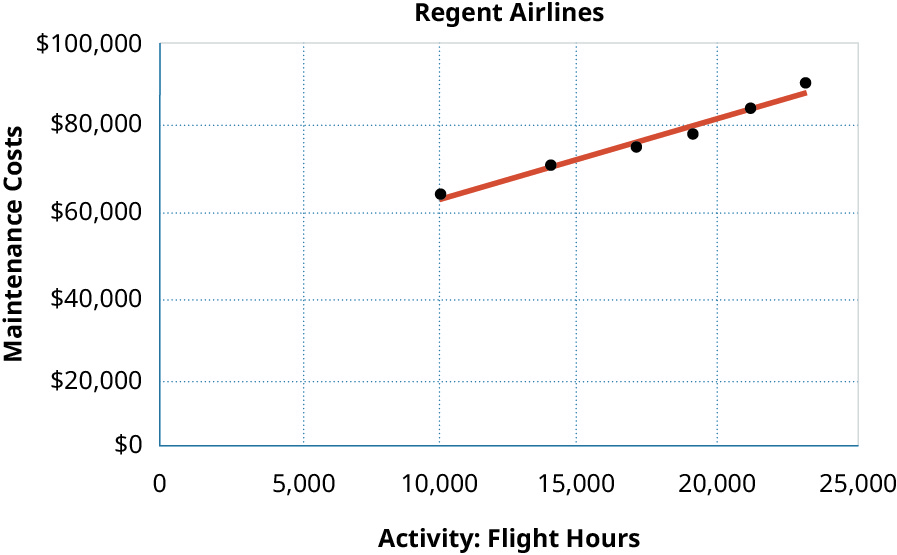

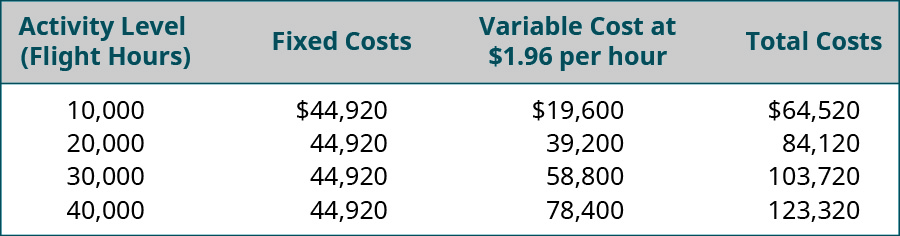

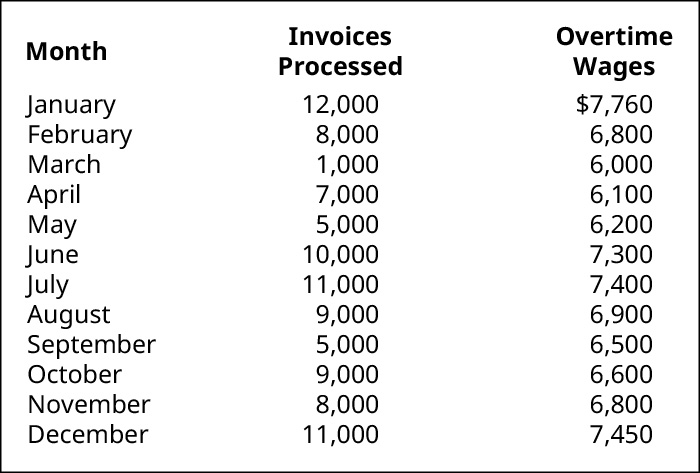

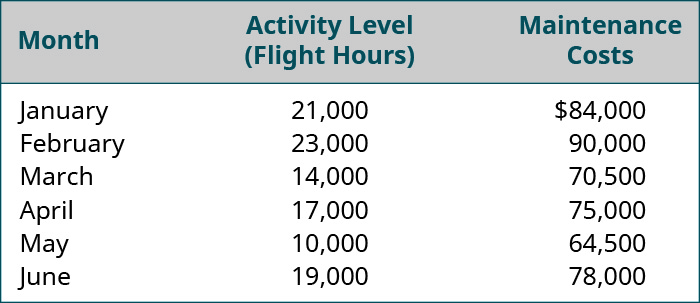

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

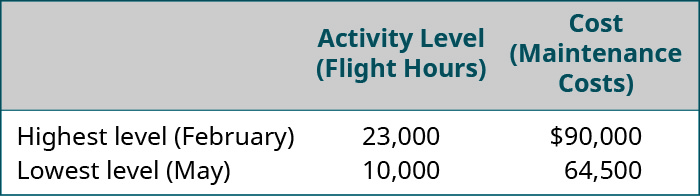

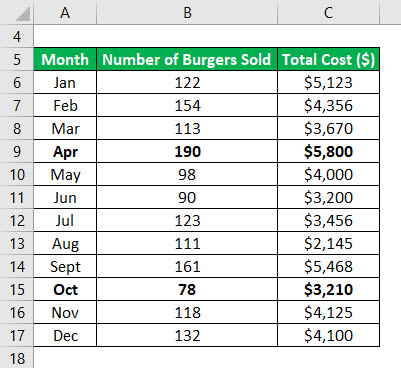

Based on the following information calculate fixed costs per month using the high-low method.

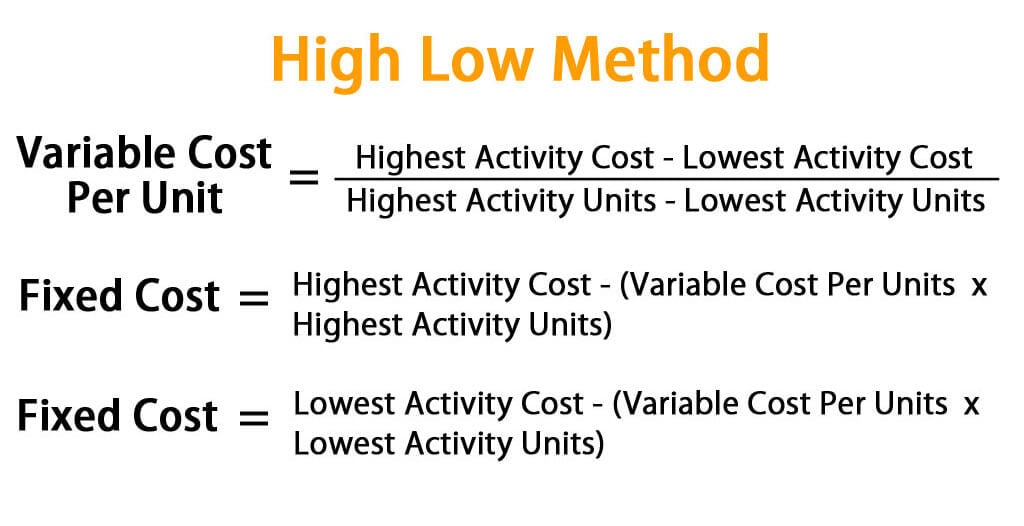

. Using the high-low method. High Low Method is a mathematical technique used to determine the fixed and variable elements of historical costs that are partially fixed and partially variable. Using the highlow method of analysis the estimated variable cost per machine hour is.

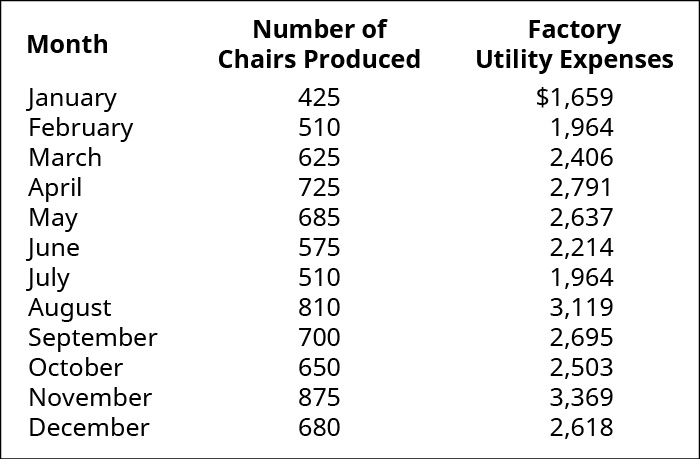

Use the high-low method to determine the hospitals cost equation using nursing hours as the cost driver. Observed that at 21000 machine hours of activity total maintenance costs averaged. High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components.

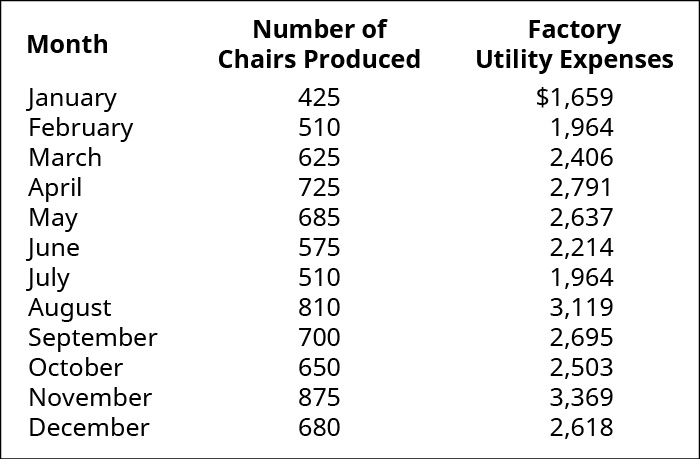

The information for 20x3 is provided below. Cost per month 39200 32000. A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver.

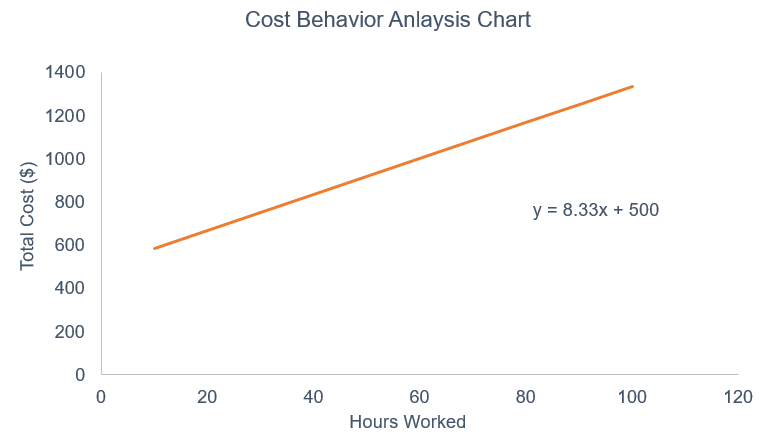

Variable utilities cost per machine hour Change in costhigh machine hour-low machine hour 4076-33881460-1030. The Hunter Company uses the high-low method to estimate the cost function. The high-low method involves taking the.

11 Barkoff Enterpeises which uses the high-low method to analye determined that machine hours best A. Given a set of data pairs of activity levels ie. High Low method is a way to calculate the variable and fixed cost element of total.

Plant activity is best measured by direct labor hours. Machine Hours 22000 32000 26000 24000 Cost 56000 May June July August Oa. Recent data are shown below.

If factory overhead is Rs 3 00000 and total machine hours are 1500 the machine hour rate is. 978-0-07-802542-6 PROBLEM 2-21 PAGE 60 PROBLEM 2â 21 High-Low Method. Battle Company which uses the high-low method to analyze cost behaviour has determined that.

To solve this using the high-low method formula subtract the lower cost from the higher cost to get a numerator of 27675 then subtract the lowest number of units from the. The formula used in computing the rate is. Uses the highlow method to analyze cost behavior.

Quarter Work hours Cost 1. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000. Requirements Using the high-low method answer the following questions 1.

Machine-hours Labor Costs Highest observation of cost driver 400. The highest and the. 200 640 Assume that management expects 500 machine hours in October.

Month Machine hours Power cost Jun 300 680 Jul 600 720 Aug 400 695 Sept. Month Direct Labor Hours Maintenance Cost. Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost.

Up to 256 cash back Get the detailed answer. In cost accounting the high-low method refers to the mathematical technique that is used to separate fixed and variable components that are otherwise part of the historical cost that is mixed in nature ie partially fixed and partially variable. Predicting Cost LO 2â 3.

Assume that the cost of electricity at a small manufacturing facility is a mixed cost since the company has only one electricity meter for air quality cooling. If Casablanca expects to incur. HIGH-LOW METHOD Key Terms and Concepts to Know Variable Fixed and Mixed Costs.

Variable utilities cost per machine hour 16 per. Units labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs ie. Machine hours 24000 15000.

Example of High-Low Method. The utilities cost associated with 1110 machine hours will be 10505. Round the variable cost to the nearest cent y 1310 x.

Assume that the relevant range includes all of the activity levels mentioned in this problem. It is the process of collecting recording analyzing the cost.

Cost Behavior Analysis Analyzing Costs And Activities Example

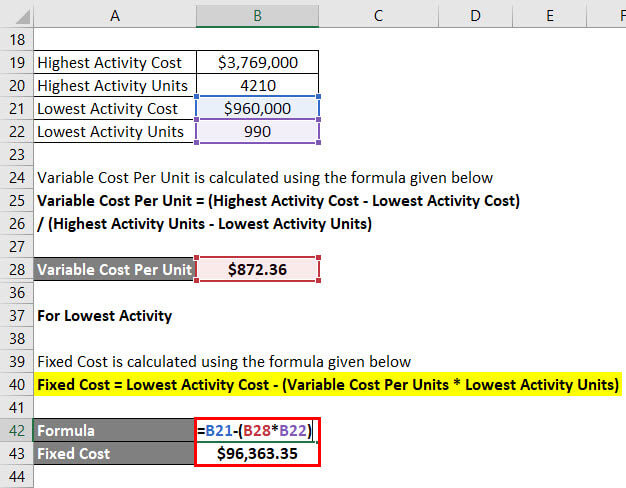

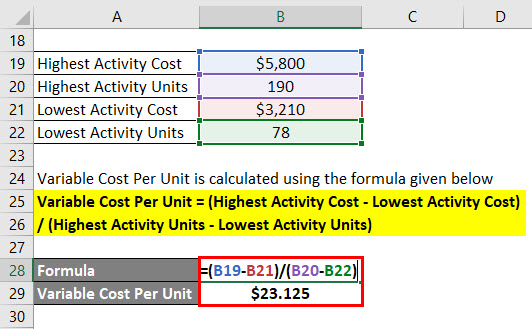

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

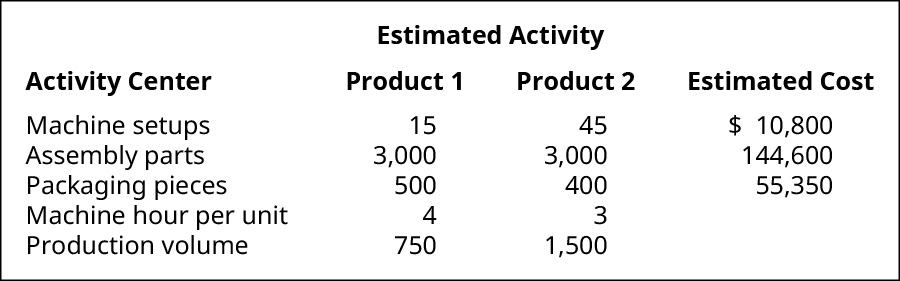

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

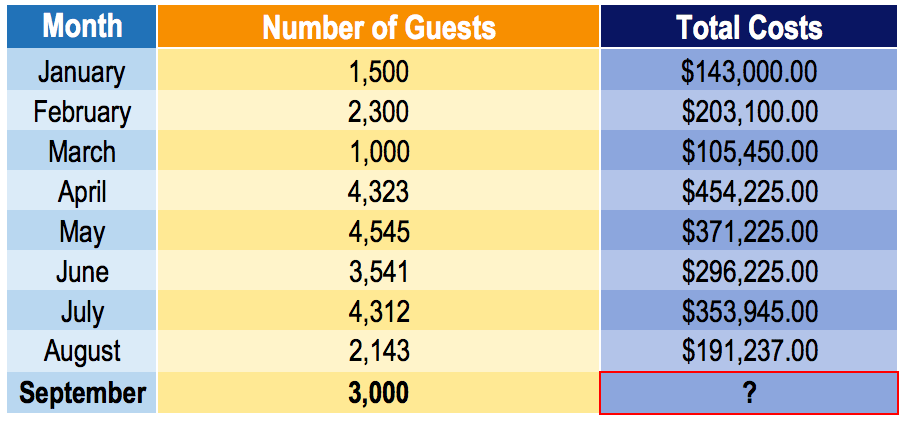

High Low Method Learn How To Create A High Low Cost Model

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Datadash Com Method To Create A Dataframe In Numpy And Pandas U Machine Learning Artificial Intelligence Data Science Machine Learning

High Low Method Learn How To Create A High Low Cost Model

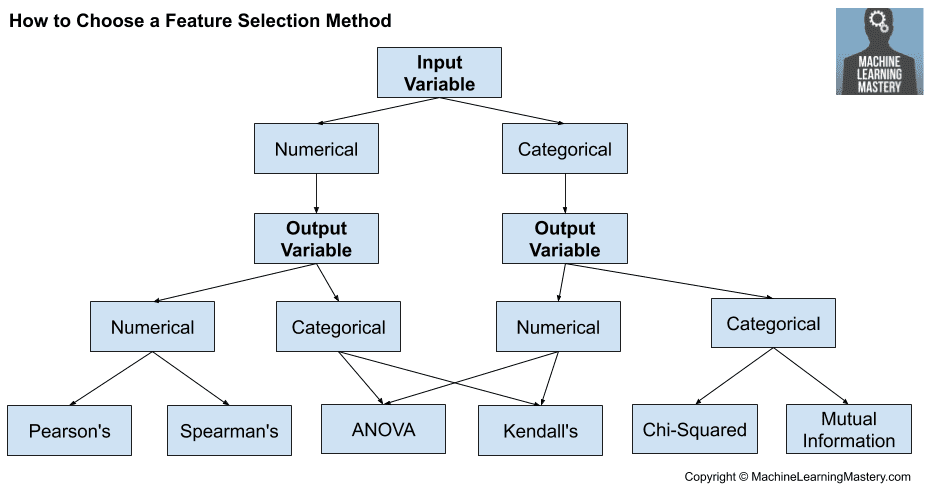

How To Choose A Feature Selection Method For Machine Learning

Pin On 2019 Upcoming Trending Styles

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

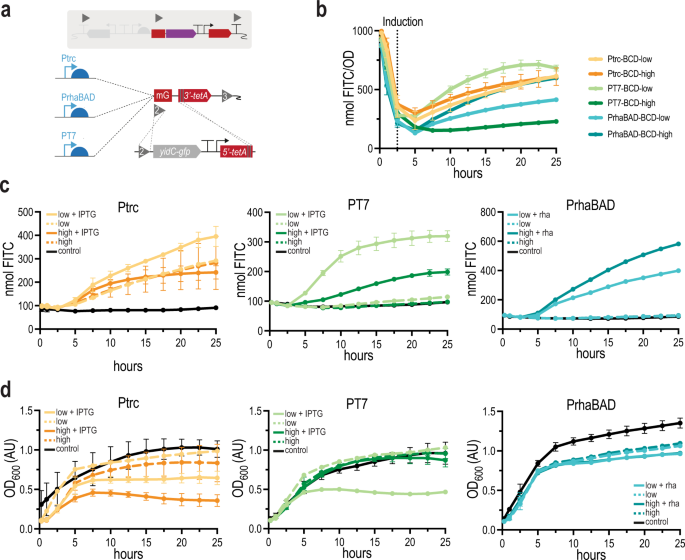

A Standardized Genome Architecture For Bacterial Synthetic Biology Sega Nature Communications

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)